Where there's will, there's a way (Father-In-Law Income)

Who would not have grown up listening/reading story of a thirsty crow, who raised the water level in earthen pot by dropping marbles into it and finally drank water? Moral of story was "Where there's will, there's a way". Recently, I got to know of a real world anecdote which captures the moral of the story of crow perfectly.

A close friend of mine Sumit (name changed) is fighting a bitter battle in court rooms with his estranged wife (knife) & Family. In between them, they have several on-going cases in various courts of the country. As is the norm in such disputes to extort money estranged knife has alleged huge dowry/Stridhan was demanded and given in marriage apart from huge sums of money spent in marriage ceremonies by her Father along with constant Domestic Violence knife was subjected to.

There is not an easy way to prove the charges of dowry and money spent in marriage false in the court of law. Sad part is that woman's word is taken as gospel truth and onus of proving her allegations false squarely falls on the shoulders of man despite cases being filed by knife. Through this blog I would like to highlight one of the ways to catch lies of estranged knife w.r.t expenditure and dowry in marriage learnt via Sumit.

Usually, there is a pretty standard format of complaints/petitions which is followed by opposition (Knife & Family). In most complaints it is mentioned that Father-In-Law (FIL) of respondent spent huge amount of money in marriage and gave dowry. Hence, it may not be a bad idea to make an attempt to find income of FIL from Income Tax Dept. An RTI with Income Tax Dept. may help. However, per RTI act even a person's father info is considered as third party and disclosure is hit by section 8(1)(j) of RTI Act, 2005, rightly so, barring few exceptions. With such Act getting details of Income of FIL is an herculean task but definitely not impossible by exploiting exceptions in above section of RTI Act.

Below is set of screen shots capturing details of RTI request, rejection by Central Public Information Officer (CPIO), appeal to First Appellate Authority(FAA) and final decision of FAA in favor of applicant resulting in disclosure of Net Income of FIL by Income Tax Dept. Usually, to get this info. one would have to go to Chief Information Commissioner (CIC) which may take years still there is no guarantee that one would succeed and by the time information is disclosed/provided it may not have any value. But carefully drafting your RTI along with a good appeal, same info. can be obtained in 1.5 to 2 months.

1. RTI Request (https://rtionline.gov.in/):

Pic- 1.

Below is set of screen shots capturing details of RTI request, rejection by Central Public Information Officer (CPIO), appeal to First Appellate Authority(FAA) and final decision of FAA in favor of applicant resulting in disclosure of Net Income of FIL by Income Tax Dept. Usually, to get this info. one would have to go to Chief Information Commissioner (CIC) which may take years still there is no guarantee that one would succeed and by the time information is disclosed/provided it may not have any value. But carefully drafting your RTI along with a good appeal, same info. can be obtained in 1.5 to 2 months.

1. RTI Request (https://rtionline.gov.in/):

Pic- 1.

i). Important thing to note in Pic -1 above is information asked is Gross and Net Taxable Incomes of several financial years not Income Tax Returns. One would know the reason Income Tax Return should not be asked below as it may definitely result in rejection.

ii). It is important to file/attach judgments in one's favor while filing RTI. For Judgments/Decisions relied upon by applicant, please refer appeal of applicant below in Pic -3.

2. Reply from CPIO:

Pic -2.

i). As is the norm/expected information sought was denied per decision of CPIO depicted in Pic -2 above according to section 8(1)(j) of RTI Act.

ii). CIC decision in case of Shri Milap Choraria vs. CBDT was quoted to buttress the rejection by CPIO.

iii). In case of Shri Milap Choraria vs. CBDT, CIC held that Income Tax Return is personal information hence exempted from disclosure under section 8(1)(j) of RTI Act.

iv). Judgments filed/attached with RTI by applicant were ignored without any reasoning.

3. Appeal to FAA against Decision of CPIO:

Pic -3.

i). Always ask for personal hearing when going for Appeal.

ii). Decision of CPIO was assailed by carefully drafting appeal (Pic -3) where in merits of CIC orders/decisions relied upon by applicant were highlighted along with error of judgement of CPIO to rely on case - Shri Milap Choraria vs. CBDT - which was related to Income Tax Return and not w.r.t Net and Gross Incomes per se.

iii). Decision of CIC - CIC/LS/A/2010/001044-DS dated 24.03.2011 in case of Sh. Manoj Kumar Saini - is landmark decision which must always be cited while asking info. w.r.t Net Income of FIL.

iv). Finally, a case was made out by applicant in his appeal in para 6 that disclosure of information would help in stopping the menace of false cases in matrimonial disputes to justify information disclosure in "larger public interest". Read exceptions to non-disclosure of information in section 8(1)(j) carefully.

4. Final Decision by FAA:

Pic -4.

i). Read para 6 in Pic -4 above depicting decision of FAA. Appeal is allowed. Hurry!!!!

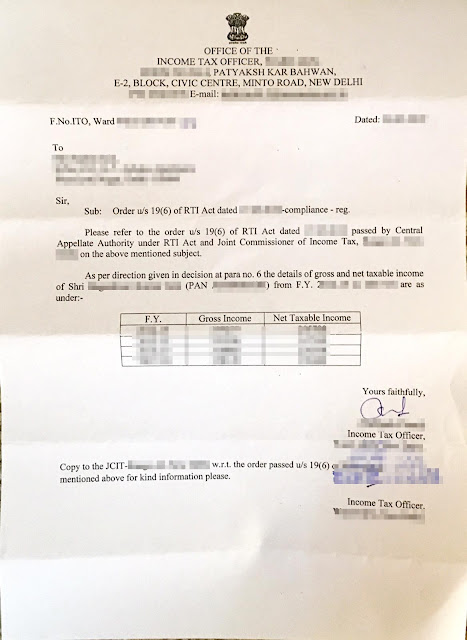

5. Info. Received from CPIO:

Pic -5.

I am leaving the task of finding decisions relied upon by applicant to readers. Decisions can easily be obtained by Googling or from CIC website.

Above information received, if timely, can definitely be used as evidence in court cases to refute the claims of knife and family.

Post-Script: There is no guarantee that by following above steps one would surely get information sought. But hey!!! there is no harm in trying.

Tikloo (MRA)

Thanks Tikloo. This is of great help. Will try in my personal case .

ReplyDeleteThanks a lot for valuable info...

ReplyDeleteThanks.

ReplyDeleteThis will definitely helpfull to all victims fiting false cases from knife&her family.